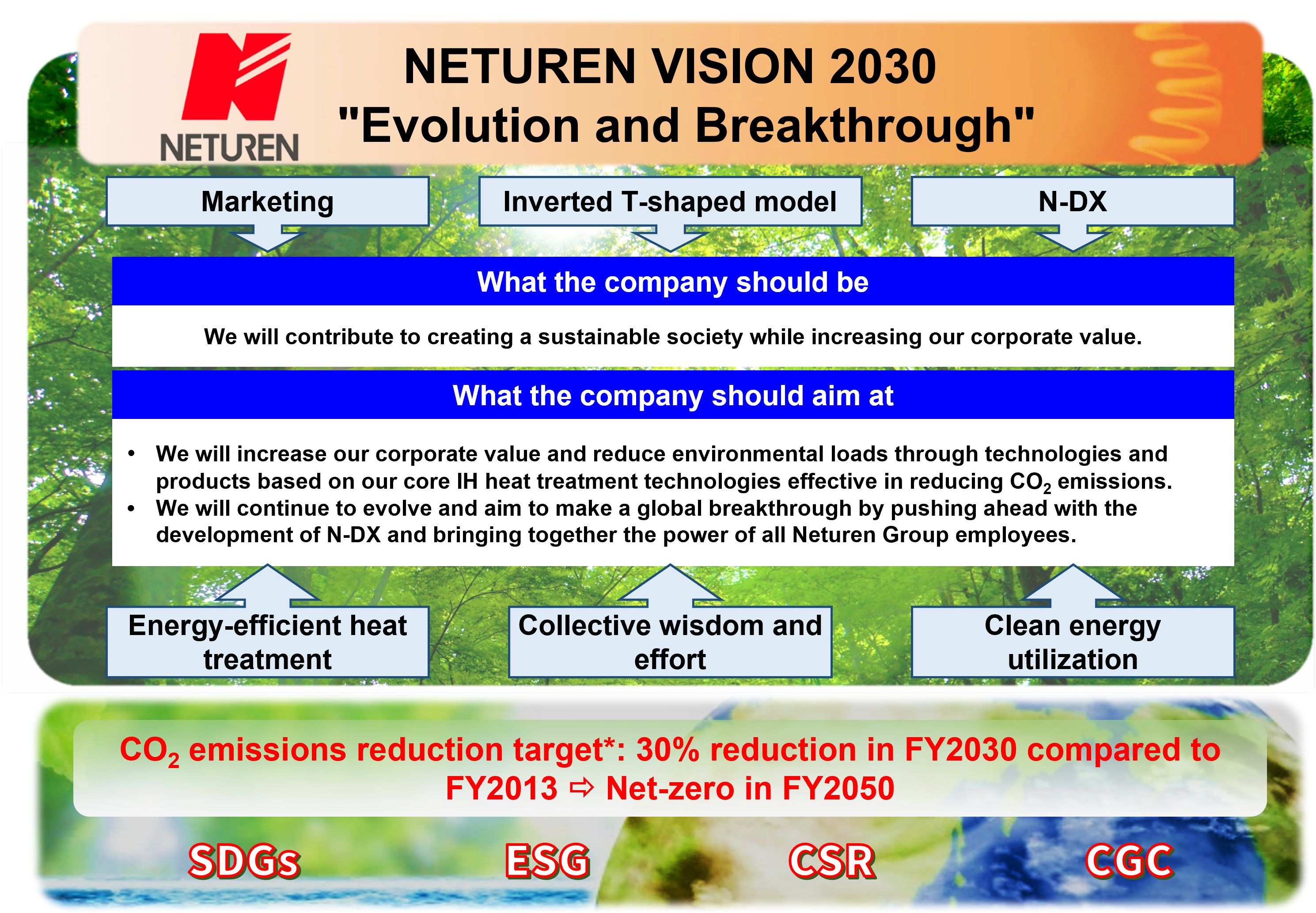

【What the company should be】

We will contribute to creating a sustainable society while increasing our corporate value.

【What the company should aim at】

• We will increase our corporate value and reduce environmental loads through technologies and products based on our core IH heat treatment technologies effective in reducing CO2 emissions.

• We will continue to evolve and aim to make a global breakthrough by pushing ahead with the development of N-DX and bringing together the power of all Neturen Group employees.

|

Technology Development |

Integrate each developing process up to mass production to create value with our advanced technology, thereby contributing to a sustainable society. |

|

Business |

Enhance corporate value with our global environment conscious equipment and products as well as through our highly efficient, outstanding quality production with fulfilling diversifying employee satisfaction (ES) to be a prestigious company. |

|

Global |

Accurately grasp global market to increase profit while gaining recognition of Neturen’s IH technology globally aiming to reduce environmental impact and achieve sustainable society. |

|

Human Resources |

Support our employees to grow as individuals with a self-motivated mind-set of contribution and can-do spirit. Foster diverse, globally capable human resources to strengthen our global competitiveness. |

the NETUREN Group formulated its long-term management vision, NETUREN VISION 2030 "Evolution and Breakthrough," and as the first phase of this vision, we have drawn up the 15th Mid-Term Management Plan and started to achieve the vision.

In the three years from FY2024, we will further accelerate the plan to achieve the vision based on the results of the first phase up to the previous fiscal year, and have formulated the 16th Mid-Term Management Plan as the second phase of growth. Under this plan, we will pursue the following initiatives with greater speed than ever before, aiming to contribute to the creation of a sustainable society and enhance our corporate value.

In the 16th Mid-Term Management Plan (Phase 2), we will further strengthen capital cost management,

We will promote business expansion by "connecting" the four strategies of VISION.

|

Technology Development |

Create New Drivers to Grow |

Based on our marketing expertise, we will create new businesses, products and technologies through flexibly bringing together our collective inter-group strengths using Inverted T-shaped model. |

|

Business |

Generate Growth Engines |

Improve production engineering to gain competitiveness of our products by bringing together new technologies and our cultivated work-site operational expertise to expand our business and win higher customer satisfaction. |

|

Global |

Expand Market Globally |

Expand the global market including untapped areas by bringing together information network and publicizing our products, services, and technologies which contribute to reducing CO2 emissions and mitigating global environmental impact. |

|

Human Resources |

Develop Employees with Self-motivation at Work |

Develop personnel who think positively, possess self-motivation and embrace diversity. Bring together individual activities to the entire NETUREN Group to accelerate our corporate growth. |

Aggressive Challenge One NETUREN 2026

Objective: “Growth, Evolution, and Breakthrough Challenge boldly

and aggressively by getting together collective resources

of whole group companies”

April 2024 to March 2027 (Three years)

|

Key Management Indicators (Consolidated) |

FY2023 results |

FY2026 Plan targets |

|

Net Sales |

57.2 billion yen |

70.0 billion yen |

|

Operating income |

1.6 billion yen |

4.6 billion yen |

|

Operating income to net sales |

2.9% |

6.5% |

|

Return on equity (ROE) |

2.6% |

6.5% or more |

|

Return on assets (ROA) |

3.1% |

5.5% or more |

|

Return on invested capital (ROIC) |

2.6% |

5.5% or more |